Joining the Popsa team? Here’s our guide on where to eat in Soho

We're fortunate to work in the heart of Soho. Within 50 meters of the office you can get food and drink from...

Read more

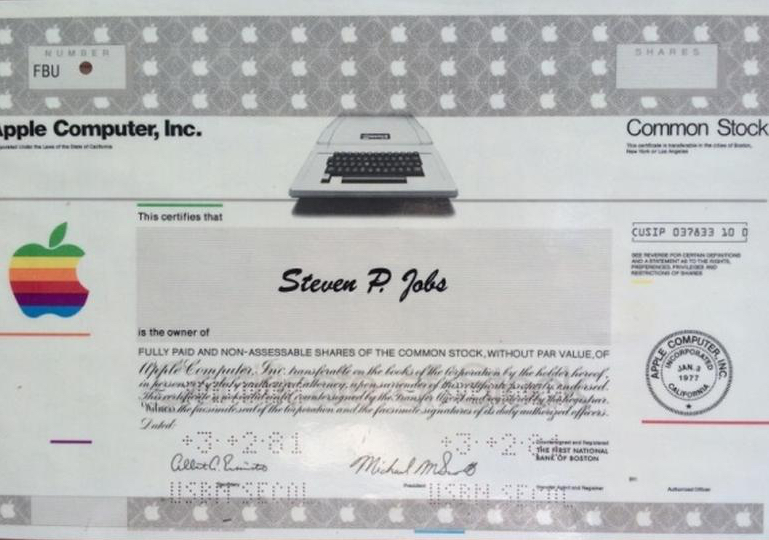

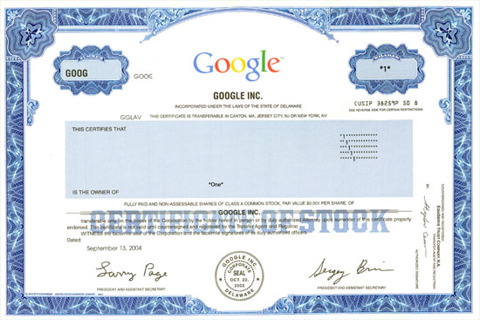

Share (or Stock) Options are the "right" of an employee to buy shares into the company for whom they work. They aim to achieve two objectives:

All "qualifying" employees get options because they are expected to contribute - each one in their own way - to the growth of Popsa. According to HM Revenue & Customs, to qualify an employee must spend at least 25 hours per week or, at least 75% of their working time, being employed by Popsa.

The founders don't get any options. This means that all options are made available to the existing and new employees, as long as they qualify.

Many startups only grant share options to their most senior employees, but we have decided to open our scheme at Popsa to all employees, no matter what their seniority is.

This means that everyone who is building Popsa gets to share in our success.

The number of options received is usually linked to several considerations, the main one being their experience.

Usually there is a link between salary and options as they both reflect the same factors, i.e., talent, knowledge, work ethic and market competition.

In Popsa, employee options convert into shares that have the same rights as the founders, this means that - unlike some other startups - when the company is sold us, the initial investors (who have bought their shares at a valuation of several million pounds), and the option holders will benefit from an 'exit' on the same basis.

Later stage investors sometime tend to have shares with some additional rights (because of the large sums of money invested) but founders and employees will be in the same boat.

Early stage startups usually set aside 7-10% (in the UK) and up to 20% (in Silicon Valley) of the original share capital for their employee options pool.

In the UK I have seen option pools as small as 5%.

Because of our decision to allow everyone in the company to own it, we have followed the Silicon Valley model for Popsa.

It is important to note that when we raise money from outside investors there’ll be a dilution for all shareholders. This is an incentive for all of us to make sure that the company grows a quickly as possible, reducing the need to raise additional capital from investors.

Yes, options have to be given a value, which is assessed on the day they are promised ("granted") to the employee based on the company's valuation amongst other things.

This crystallises the purchase price...

Some good news here: employees don't have to pay for them up front.

When you are granted options through an Option Agreement, you acquire the right of buying the shares but you only need to acquire and pay for them when there is a clear opportunity to subsequently sell the same shares, i.e., when a public listing or a sale of the company is imminent.

By that time, the value of the shares will (hopefully!) be worth much more than what they were worth when you were granted the option to buy them.

So if you have the option to buy shares at £1 and the company is sold for £100 per share, you will pay the £1 and receive the £100 at the same time, which means that you'll end up with £99 profit per share.

Under Popsa's EMI scheme no income tax or national insurance is payable when options are granted (i.e. when they are offered to the employees). And again, no income tax or national insurance is due when the shares are exercised (i.e. the day they are purchased), as long as they were granted at market value. This is a requirement by HMRC designed to prevent people avoiding tax via the purchase of shares.

When the shares are sold, the employees who are still employed by the company will be liable for a reduced rate of capital gains tax (CGT). The entrepreneur’s relief rate is only 10%. Employees can also use their annual CGT exemption, so it is possible to pay less than 10% tax.

If an employees leaves before a sale or a flotation the options will not have vested.

When an employee leaves they can exercise their options but only if they are "vested". They would buy them at the value agreed when the options were granted.

The payment due will be quite low for the employees who started to work with Popsa at the beginning of its life but could be higher for the ones that will have started at a later stage.

If a flotation occured, employees would be able to to sell their shares and Popsa would allow them to exercise their options until up to ten years from the day they were granted.

Obviously, it is important that this type of reward is made available to people who have contribute to the success of the company.

This means that employees must remain with Popsa for a pre-defined period before they will have acquired the right to purchase their options.

For startups this period usually is the time up to an "event" — a sale or a flotation.

This apply to Popsa too, which means that shares are fully vested at the time of an event, when they can be bought and sold at the same time.

Some good news here: if an event happened even just immediately after an employee's probation period has ended, they would automatically fully vest at that point.

Definitely!

And especially if the company is in its infancy and has a generous scheme.

Here at Popsa all of your colleagues will be contributing to each other's reward.

That's the plan!